Pandemic Outlook: Light Industrial Demonstrates Resilience in the Face of Covid-19 Economic Shock

The impact of the pandemic has been wide-reaching, touching every aspect of our lives. It is affecting where and how we work, with whom we interact, and where we feel comfortable purchasing our necessities of daily life. The fear and uncertainty evoked by the virus combined with the lock-down policies adopted in its immediate wake contributed to an unprecedented negative demand shock that sent the global economy reeling and left the US economy with its largest quarterly contraction in recorded history. Despite this, light industrial real estate continues to perform.

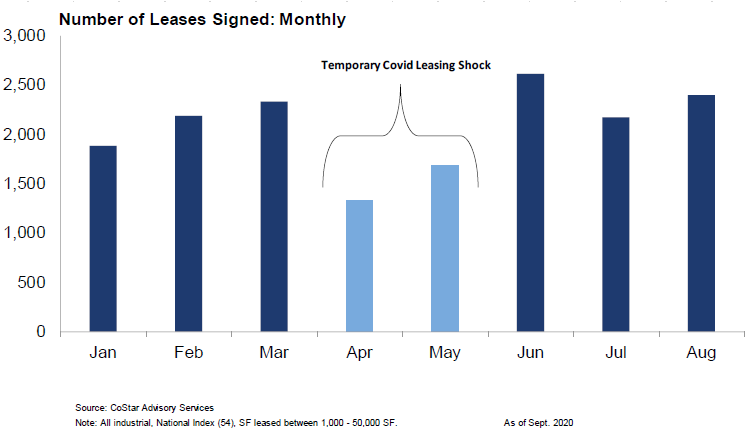

After a two month pause in leasing during the height of virus induced uncertainty, light industrial has demonstrated resilience and even strength with leasing recovering to levels greater than had been achieved in the months leading up to the pandemic[1]. One immediate consequence of the social distancing policies instituted in response to Covid-19 has been the accelerated adoption of e-commerce. This trend has contributed to the recovery in leasing, as industrial operators responded to the very clear shift to digital consumption. As a result, the need for firms to carry higher inventories in more locations has given industrial operators the confidence to sign leases at a time when other areas of the economy remain in doubt.

The data bear this out. According to the Census Bureau, e-commerce sales were up nearly 45% year-over-year as of Q2 2020. This prompted Moody’s research analysts to publish a report projecting e-commerce to reach 25% of total retail by 2025, nearly a 2.5x increase from the present. Given the strong link between e-commerce and light industrial, this trend portends bullish growth.

[1] CoStar Group, 2020