More Room for Institutional Capital: Fragmented Ownership and Cap Rate Spreads Suggest Room for Further Capital Allocation

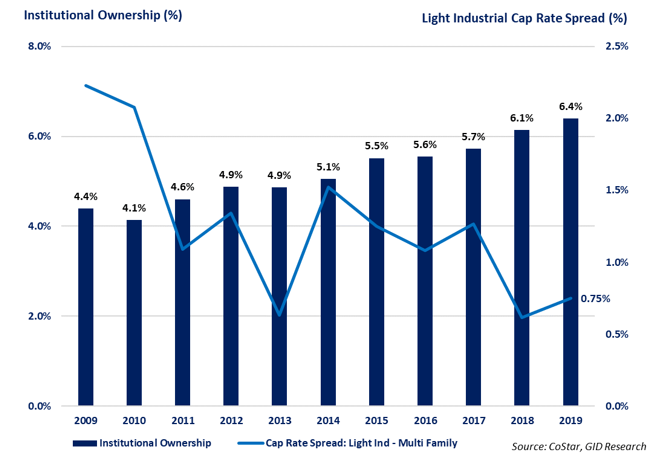

Over the past five years the industrial sector has dramatically outperformed the NCREIF Index, achieving an average annual return of 13.7% compared to 8.8% for the remainder of the index. Light industrial’s sharp rent and price appreciation has played a significant role in that outperformance, attracting a slew of new institutional investment into the sector. While sectors such as office and multi-family have long been havens for institutional capital, light industrial has only recently joined the club. NCREIF survey data indicate that institutional ownership of industrial real estate has increased steadily this cycle, growing from an estimated 4.4% to 6.4% in the past 10 years[1].

The growing institutional appetite for light industrial is also evident in cap rates. The cap rate spread investors afford light industrial over multi-family properties has compressed meaningfully in the current economic cycle. In 2009, light industrial cap rates were 220 basis points higher on average compared with multi-family. Today, that cap rate spread is 75 basis points[2].

Rapidly growing institutional ownership and cap rate compression are both signs of the investment community’s bullishness on the light industrial sector, but the market remains largely underinvested relative to other product types. A history of fragmented ownership has kept deal sizes within light industrial smaller than other sectors, acting as a barrier to the kind institutional concentration seen in office and multi-family, where large equity checks are more common. Within the industrial sector, light industrial assets require even smaller equity checks, and meaningful cap rate spreads are still available.

Please contact industrialresearch@gid.com for additional information.

[1] NCREIF 2019 Q2

[2] CoStar Group, 2019: Estimate of Institutional Cap Rates